How to Open a Bank Account in Japan for Students (2025 Guide)

Welcome to Japan! As you settle in for your studies, one of the first essential tasks you’ll face is setting up your finances. This guide will show you exactly how to open a bank account in Japan for students. The process can seem daunting, especially with the language barrier and local rules, but we’ve simplified everything into easy, actionable steps. Follow this guide, and you’ll have your new Japanese bank account in no time.

The First Thing to Know: Japan’s 6-Month Resident Rule

Before you even walk into a bank, you must understand a critical rule in the Japanese banking system. For banking purposes, foreigners are categorized in two ways:

- Non-Resident: Anyone who has been in Japan for less than 6 months.

- Resident: Anyone who has been in Japan for more than 6 months.

As a new student, you are a “non-resident.” This means any bank account you open will have one major limitation: you cannot make or receive international wire transfers. This is a legal measure to prevent money laundering. Your first account will be for local use only—perfect for daily expenses and receiving a salary, but not for getting money from home directly.

Required Documents: Your Bank Account Starter Kit

Being prepared is key. To successfully open your student bank account in Japan, gather these essential items before heading to the bank.

- Your Residence Card (Zairyū Kādo): This is the most important document. Ensure your current address is printed on the back. You must register your address at your local city or ward office to get this done.

- Your Japanese Phone Number: It is nearly impossible to open an account without a local Japanese phone number. Make getting a SIM card a top priority. (If you want to know how to get a Japanese phone number, check our guide here.)

- Your Passport: An essential form of photo ID.

- Your Personal Seal (Inkan): While some modern banks may accept a signature, an Inkan makes all administrative tasks in Japan smoother. You can get a simple one made cheaply and quickly at shops like Don Quijote.

- A Small Amount of Cash: You’ll need to make an initial deposit, usually just ¥1,000 is enough.

Which Bank is best to open a bank account in Japan for Foreign Students?

Not all banks are equally friendly to newly arrived foreigners. For a hassle-free experience, your choice is clear.

Top Recommendation: Japan Post Bank (Yūcho Ginkō)

Japan Post Bank is, without a doubt, the best option for a student who has been in Japan for less than 6 months.

- Why it’s the best: They are located in post offices everywhere and are the most experienced and welcoming institution for foreigners. Their staff are familiar with the process for non-residents, meaning your chances of being turned away are almost zero if your documents are in order.

- The process: Simply take your documents to the banking counter at any Japan Post Office.

What About Megabanks like MUFG, SMBC, or Mizuho?

While these are excellent banks for long-term residents, they are often very strict and will likely require you to have lived in Japan for over 6 months before they will open an account for you. To save time and avoid frustration, start with Japan Post Bank.

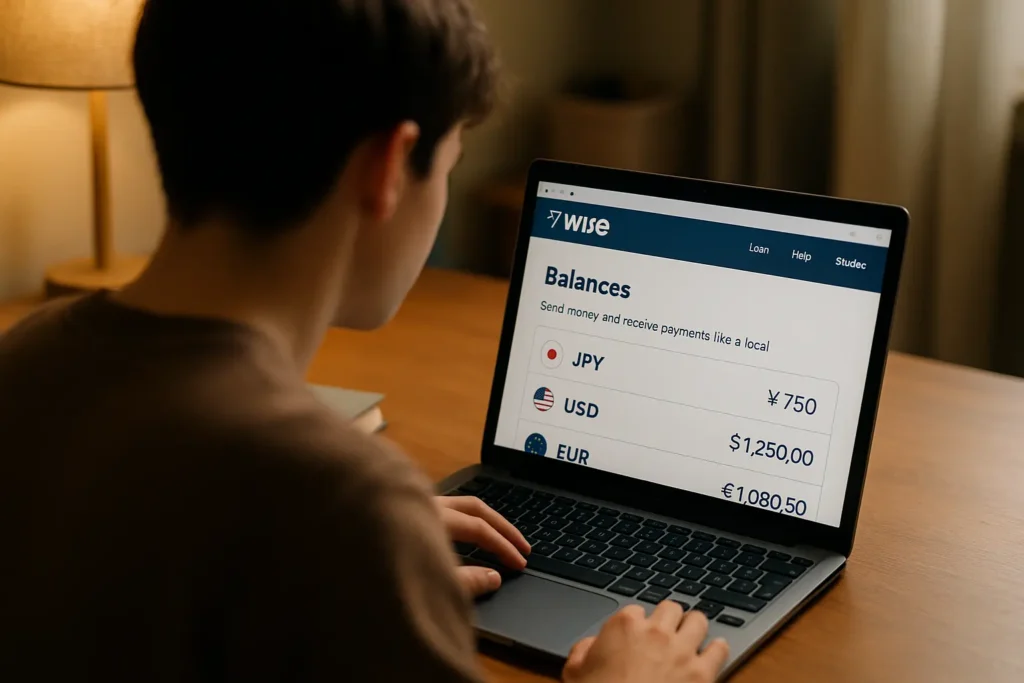

How to Receive Money From Abroad (The Wise/Revolut Solution)

So, how do you get money from your family if your new Japanese account can’t receive international transfers? The answer is to plan ahead with a modern financial service.

Wise (formerly TransferWise) is the most essential tool for this. Before you leave for Japan, create a Wise account. It allows you to hold multiple currencies (including JPY) and gives you virtual bank details. Your family can send money to your Wise account, and you can use the Wise debit card to pay for things in Japan or withdraw cash from ATMs. It’s a simple, cheap, and indispensable workaround for your first six months.

How-To: Your 5-Step Action Plan to Open of Bank Account in Japan.

- Step 1: Prepare Before You Leave. Open a Wise or Revolut account online and order their debit card. This will be your financial bridge for the first six months.

- Step 2: Handle Your Immediate Arrivals. Once in Japan, go to your local city/ward office to register your address on your Residence Card. Then, get a Japanese SIM card and phone number.

- Step 3: Open Your Account at Japan Post Bank. Go to the nearest post office with all your documents (Residence Card, passport, Inkan, phone number) and the initial cash deposit to open your Yūcho Ginkō account.

- Step 4: Manage Your First 6 Months. Use your Yūcho account for daily life in Japan (receiving salary, paying bills). Use your Wise/Revolut account to receive funds from your home country.

- Step 5: Upgrade Your Account. After living in Japan for six months, return to the bank with your Residence Card. Inform them you are now a “resident” to upgrade your account and unlock international wire transfer capabilities.

Frequently Asked Questions (FAQ)

- Q1: Can I open a Japanese bank account online before I arrive in Japan?

- A1: Unfortunately, no. You must have a Residence Card with a registered Japanese address to open a bank account, which you can only get after you arrive.

- Q2: Do I really need a personal seal (Inkan)?

- A2: While it’s becoming less common, many situations, especially in more traditional banks or offices, still require an Inkan. It’s a small investment that can save you a lot of trouble. We highly recommend getting one.

- Q3: Can I use my new Japanese bank account to receive my part-time job salary?

- A3: Yes, absolutely. The basic non-resident account is perfect for receiving domestic transfers like a salary from a Japanese employer.

Conclusion: Banking in Japan Made Easy

While the rules might seem complex, it’s easy to open a bank account in Japan as a student when you’re prepared. By starting with Japan Post Bank and using a service like Wise for international funds, you can set up a smooth and stress-free financial life. This allows you to focus on what really matters: your studies and enjoying your incredible adventure in Japan.